Thanks, as always, for reading. There is a lot of great news coming out of the firm recently. The biggest news is that we’ve launched a new company, Gertsburg Licata Acquisitions, to help middle-market clients grow through acquisitions.

We’re also well into our popular podcast series, Best.Podcast.Ever: My Colossal Failure, where our favorite entrepreneurs tell us the story of how they overcame their biggest existential professional and personal crises.

Lastly, more and more, we’re becoming a one-stop-shop for our friends’ and clients’ business growth needs. Our superpower is helping our clients grow – by removing legal and other roadblocks, by helping them with capital needs, by recruiting their next executive, and other innovative ways. Here’s a list of ways we help our clients other than through the practice of law. If we can help you in one of these ways (or any other way), please just ask!

“Burning our Ships” – An Ode to the Startups and to the Risk-Takers

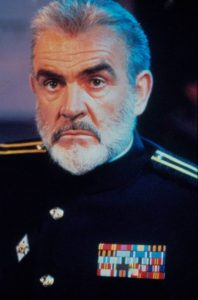

There’s a great scene in The Hunt For Red October when Marko Ramius (exquisitely portrayed by Sean Connery), has just alerted the Russians that he is defecting to the United States. His first mate asks him why he would alert them, especially after he had just stolen the Russians’ best nuclear submarine. The Russians would definitely hunt them down and try to sink them and kill them. This was their dialogue:

First Mate: We could still go back.

Marko Ramius: There will be no going back. Before we sailed, I dispatched a letter to Admiral Padorin, in which I announced our intention . . . to defect.

First Mate: In the name of God, why?

Marko Ramius: When he reached the New World, Cortez burned his ships. As a result, his men were well motivated.

Marko Ramius and Hern Cortes weren’t alone. Alexander the Great did the same thing in 334 BC when he led his troops across the Dardanelles to fight the Persian army. When he heard his troops were talking about retreating, he ordered his ships to be burned, telling his men: “We either return home in Persian ships, or we die here.” His men could not turn back even if they wanted to.

We have burned many ships on our way to building our companies, and on our way to improving our lives in general. You try not to burn them, of course. You try to hedge your bets. But that’s not always possible. You have to decide how confident you are in your own abilities and those of others with whom you can surround yourself. You have to know that failure is in your future and then, to use another metaphor from my friend Paul Marnecheck, you have to “throw your hat over the wall and then figure out how you’re going to get it”.

History is replete with ship-burners. Elon Musk staked his entire $165 million payout from the sale of PayPal on two new companies that had no real products and no real customers, SpaceX and Tesla. Everyone thought he was insane and both companies were days away from missing payroll and filing for bankruptcy – several times. Today, both companies have launched entire industries (pun intended). Phil Knight had one bet-the-company crisis after another while building Nike. It was constantly insolvent, buried under crippling debt for almost eighteen straight years, all so that Knight could see through his vision of creating the perfect running shoe. (If you haven’t read Shoe Dog, stop what you’re doing and start reading. It’s outstanding.)

A great local example is Aaron Grossman, whose company, the $130 million Alliance Solutions Group, had to be bailed out by a close friend and investor after nearly failing in its early days. (Listen to Aaron’s great story here).

(I can speak from my own experience. My ship-burning started in 2012, when I left a good, steady paycheck in exchange for enormous risk, total uncertainty, and massive potential financial failure. I broke off personal and even family relationships that were negatively influencing my growth and sanity. I took out giant loans to finance our company, knowing that defaulting on them would mean bankruptcy. Today, our company has grown more than 10-fold from those first years.)

The list of examples goes on forever because making big bets is what entrepreneurs do.

Some will tell you that burning your ships only makes sense when you win. That’s when the narrative sounds right. When you burn your ships and lose you feel like an idiot.

I disagree.

First, feeling like an idiot is a choice. The better option is to know that failure is your friend. After you are ship-less and hat-less, what’s your next move? You’re still alive, you’ve learned from the experience; now you have to get back on that horse and get back into the battle.

Second, and this is probably obvious but worth repeating: you never burn your ships if you don’t have to. It has to make sense on some well-calculated and well-reasoned level. (Check out this prior issue of The Fix to learn a really great problem-solving process and cheat sheet to help with that analysis.) It has to have been the result of necessity, analysis, and above all, comfort and confidence that after you’ve burned them, you’ll either thrive or survive. Staying doomed and marooned can never be the final result.

So if you have to burn your ships, know that you’re not the only sailor to have done so. You’re in great company.

No Assignment, No Dice.

When signing and negotiating important contracts, pay attention to assignment provisions. Basically, you should always anticipate that, at some point down the road, you may want to have someone else perform your contract. You may sell your company. You may subcontract. You may create a joint venture with a competitor or a new partner. In these and other such cases, you want the ability to assign your contract to the new entity without having to get permission.

Leverage comes into play here. For example, your lender will always prohibit assignments for obvious reasons. The bank wants to lend money to you and only you. You’re not assigning if you want the money, at least not without the bank’s consent. The same is generally true of other companies with whom you do business, though, if they’re paying attention, and the same is true for you.

A typical provision might say: “[Your company] may not assign or transfer any part of this Agreement without the written consent of [the other Party]. Any attempt to transfer or assign is void.” If it’s mutual, it might say “No Party may assign or transfer any part of this Agreement without the written consent of the other Party.”

Consider starting with your own form and then using this language: “[Your company] may assign its performance to any third party upon notice to [the other party]. [The other party] may not assign or transfer any part of this Agreement without the written consent of [your company]. Any other attempt to transfer or assign is void.”

See what they do. If they balk, you have several options: you can use the mutuality language above; you can strike it completely; or you can require consent but then add, “which consent will not be unreasonably withheld, conditioned or delayed.” You’ll want to discuss those and other options with your attorney to account for any legal and factual nuances.

Not an option: Ignoring assignment language. Give it some thought before starting a contractual relationship. You’ll be glad you did when you want to subcontract or sell the business down the road.

Side note: Speaking of banks, ever wonder what happens if you want to sell your business while having an outstanding PPP loan? Check out our recent article on that subject.

The Data Privacy Dilemma

The next time you need a healthy dose of perspective about your place in the world (which is really all the time, isn’t it?), check out this crazy Scale of the Universe app. It’s fantastic.

Also, if you love coffee as I do… I just finished reading The Monk of Mokha by David Eggers. I have an entirely new appreciation for how coffee is made and distributed through the entire supply chain. And it’s written through a true-life adventure tale about the Yemenese civil war. Hard to believe it all happened that way. Great read.